I represent many people that file bankruptcy, have a short sale or foreclosure. So, I get the following expected questions on a regular basis.

After Bankruptcy – When Do I Qualify To Buy a Home?

After Foreclosure – When Do I Qualify To Buy a Home?

After Short Sale – When Do I Qualify To Buy a Home?

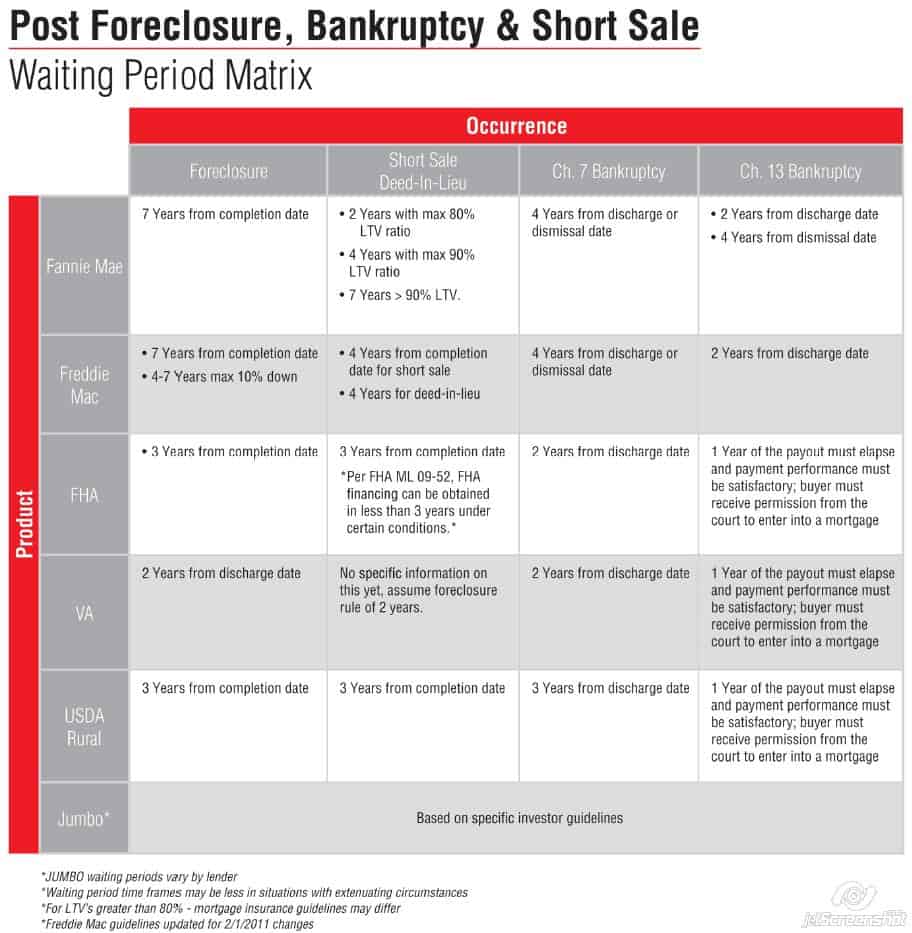

In 2018 a good friend that happened to be a mortgage loan officer with experience provided me with the matrix below. I believe it can still give you a decent idea of what lenders think about new mortgage / home loans following a bankruptcy (Chapter 7 & 13), foreclosure and a short sale.

To determine when you might qualify for a loan, just find your event across the top “Occurrence” row (Foreclosure, Short Sale, Deed in Lieu, Chapter 7 Bankruptcy, Chapter 13 Bankruptcy) and drop down until you get into the “Product” column with the type of loan you are seeking (Fannie Mae, Freddie Mac, FHA, VA, USDA Rural, Jumbo). The information in the intersecting box indicates when you are now might qualify for a loan (i.e., when the “occurrence” no longer disqualifies you from that type of loan).

(article continued below)

A Good Credit Score Is Still Needed

Of course, once you get past the “occurrence”, you will still have to have good credit score to qualify for the loan. My article on life “After Bankruptcy” discusses how your credit score is calculated (see section entitled, “6. Understand How Your Credit Score is Calculated – and Act Accordingly”). The good news is that a credit score can be rebuilt in time to qualify for a new home loan. As proof, I have a client in an active Chapter 13 that just qualified for a $200K home mortgage. So, yes, it can happen.

If You Need To File Bankruptcy And You Don’t …

Also, people need to remember that while filing bankruptcy can disqualify them for a home loan for a while. not filing bankruptcy if it is needed can be worse. In short, if a person has a whole bunch of past-due debts still owed and maybe a few judgments and garnishments, do you think they are going to easily qualify for a good home loan? I suggest not. Their credit score is going to be terrible with all of the negative items on their report. A bad credit score means no home loan. I’ll further note that judgments in Washington are good for ten years and, if unpaid, can be renewed for another ten years. From the chart above, you can see that filing bankruptcy can disqualify you from a home loan for one to four years. If you need to file a not file, you might be disqualified for up to twenty years. You get the idea.

Free Initial Consultation

If you are experiencing financial problems, feel free to contact us and request a free initial consultation. We have the experience and information you want/need in order to make a good decision.